The Regulatory Commission of Alaska has issued a final approval in the sale of BP’s Alaska assets to Hilcorp Energy Company and their affiliate, Harvest Alaska.

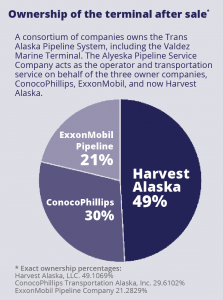

This purchase includes the transfer of the largest percentage of ownership of the Trans Alaska Pipeline System to Hilcorp Energy and their affiliate, Harvest Alaska.

The sale has been controversial. In March of 2020, the Regulatory Commission of Alaska issued an order approving the company’s request to keep their financial documents confidential. That order generated extensive public comments from Alaskans, including the Council.

One of the commissioners, Stephen McAlpine, dissented in that March order. He noted that he believed “airing these documents publicly and subjecting the entire transaction to intense debate far outweighs the petitioners’ interest in keeping them confidential.”

Sale moving forward

In December, the commission issued an order allowing the sale to go forward, however certain conditions must be met. Some of these conditions include:

- BP is required to file a written declaration confirming they remain responsible for dismantling and removing equipment and restoring the land after the Trans Alaska Pipeline System is decommissioned. This commitment applies to the facilities as they exist at the time of the sale. Harvest would be responsible for dismantling any new facilities.

- The order requires Hilcorp and Harvest to submit financial statements and a summary of their insurance coverage every year to regulatory agencies. BP is also required to file financial statements with the same agencies.

- Additionally, the companies must submit a report to the Alaska Department of Natural Resources , or DNR, that details the expected cost to dismantle and restore these facilities. This report must be completed by December 31, 2021. Future updates to this report will be due to the commission every three years.

These future filings would remain confidential.

Concerns remain

The Council does not oppose the sale itself. However, concerns remain. Because the financial documents are not available for review, the Council has been unable to verify the new owners’ ability to maintain the system and potentially respond to an oil spill. The manner in which this transaction was approved, including the ruling to keep information confidential, sets a dangerous precedent for future TAPS owner transactions.

More details

Find information on the commitment to restore the land, the tariff that is intended to pay for the restoration, and a summary of the government agencies responsible for overseeing the transaction in a previous edition of The Observer: Sale of BP’s Alaska assets to Hilcorp under scrutiny (April 2020)

The RCA’s order approving the sale is available on their website at: RCA Order 17